The article gives an overview of what are accounting source documents and what are their goals, content, and examples.

You can also listen to this article:

Table of Contents

Accounting source documents are documents that provide proof of economic transactions.

They are the source of the information that is recorded in the accounting ledgers, and they are used to verify the validity of the transactions.

Accounting source documents are required, for example, to prove the following transactions:

Simplify your manufacturing accounting with MRPeasy

The aims of creating and keeping accounting source documents are:

In all cases, the accounting source documents must contain at least:

According to local legal regulations, a company must retain source documents for several years.

Beyond these requirements, each company dictates its own security policies. It may be convenient to keep these documents for longer. It may be useful in the future to provide evidence in case of internal consultation, a lawsuit, or to provide better customer service.

Likewise, every company must have a procedure about the source document destruction policy. This procedure helps organizations to control the elimination of such documents for a certain period of time.

Accounting source documents can be categorized also as internal or external, depending on if they were generated within the company, or received from another party (e.g. seller of goods).

Generally, external source documents are considered more important, as they provide proof that your company did have a transaction with another party. For example, if your company purchased something, but does not have any payment documents from the seller, then the accountant does not have the right to record such entry in the books.

Every business must record every economic transaction on their books and have enough evidence to support it. Some common source documents used are described below:

When a company sells any product or service to another party, it issues an invoice or a bill. The invoice shows the description of the product, the parties involved in the transaction, the date, the quantity and the price.

Any time an invoice is issued there is a copy for the buyer and another for the seller.

A receipt is a financial source document that provides proof that cash was transferred from one party to the other.

The receipt contains the names of the two parties involved in the transaction, the date, the amount of money transferred and the currency.

For example, when a person or a company pays for a product, a cash receipt is supplied as proof of money transferred.

The check printed from a cash register provides proof that a purchase was paid for in cash or by card.

A purchase order is a source document issued by the buyer to the seller. Initially, it requests a product or a service, but it is a binding agreement once the seller accepts the purchase order.

Sometimes the purchase order comes after a previous process of negotiation. During that stage, both parties, the buyer and the seller, agree on the terms and conditions.

A purchase order contains the description of the items, the quantities to purchase, the price, the delivery dates, and the payment terms.

A sales order is a document generated by the seller upon receiving a purchase order from a buyer. To accept the purchase order, the seller issues an order confirmation specifying the product details: the product or service with the price, the quantity, the delivery terms, and the seller and buyer details.

Based on the sales older the seller can generate an invoice for the buyer.

The delivery note is a document that is sent together with a shipment of goods that provides proof that the goods or products have been delivered.

The delivery note usually shows the names of the parties, delivery location, the date, and the descriptions and quantities of items in the transaction.

A copy signed by the buyer is returned to the vendor as proof of delivery.

The goods received note (GRN) is like the delivery note, but in this case, it will be issued by the buyer.

It also shows the name of the parties involved in the transaction, the description, the quantities of items in the transaction, the date, and delivery location.

The goods received note can be sent to the seller when the transaction has been completed. It is used to match received goods to invoices received from vendors.

Start properly managing your manufacturing companyMRPeasy integrates sales, purchases, production, inventory, and finances to provide you with an accurate real-time overview of your business.

The debit note can be sent from the buyer to the seller together with returned goods. In this case, the buyer notifies the seller that they do not intend to pay for the goods if purchased on credit, or they expect a refund or credit from the seller if goods have already been paid for.

Also, the debit note can be sent from the seller to the buyer when the amount payable by the buyer increases. In this case, the seller notifies the buyer that in their accounts they have increased the amount what the buyer owes to the seller. Formally, it can serve as a request for extra payment from the buyer, e.g. when there were changes to the original invoice.

The credit note can be sent by the seller when the buyer has returned the product to the seller, fully or partially. In this case, the credit note indicates that the buyer does not need to pay for these products if purchased on credit, or that the seller now owes the buyer a refund, if the buyer already paid for the products.

Also, the credit note can be sent from the buyer to the seller, in response to receiving a debit note, to acknowledge a seller’s claim.

The time card is an internal document that companies use for registering the working hours of the personnel and pay wages. The time card records the name of the employee, the working day, the entry time and the exit time.

The time card has evolved over time, from the traditional paper time card to the magnetic card or fingerprint records.

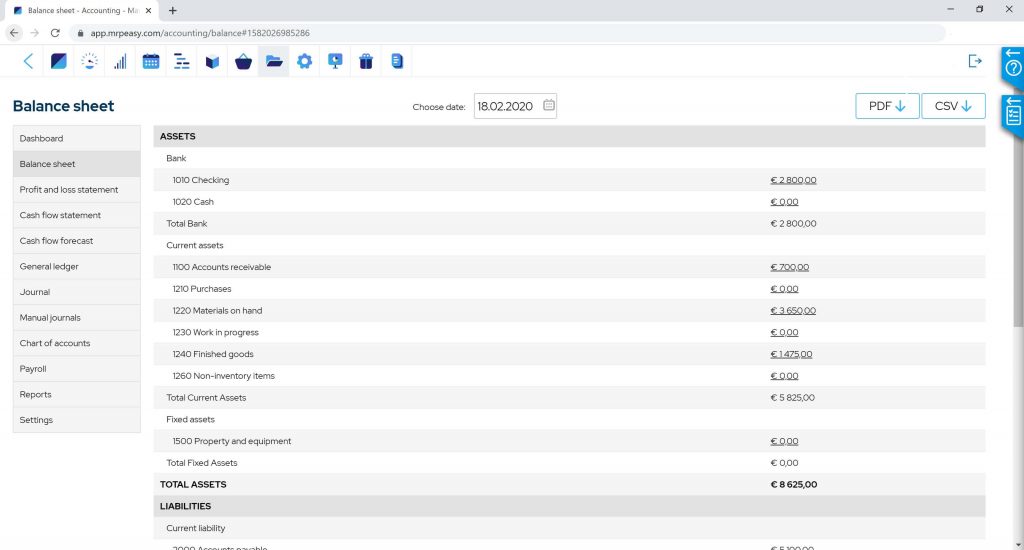

A bank statement is used to enter payments into the accounting system and match them to invoices. During an audit, the bank statement allows to verify that the payments entered into the accounting system, the movements shown in the bank accounts in the company’s records, actually happened, and show who the receiving/sending party was.